Best in class insurance partners

Why Do Restaurants Need Liquor Liability Insurance?

In the restaurant industry, it’s common to serve alcoholic drinks, both at the table and the bar. However, it’s not so common to easily identify drunk or underage customers, particularly when you’re busy or understaffed. If the drunk customer then causes harm to somebody else, even elsewhere after they’ve left, you could still be held liable under “Dram Shop” laws.

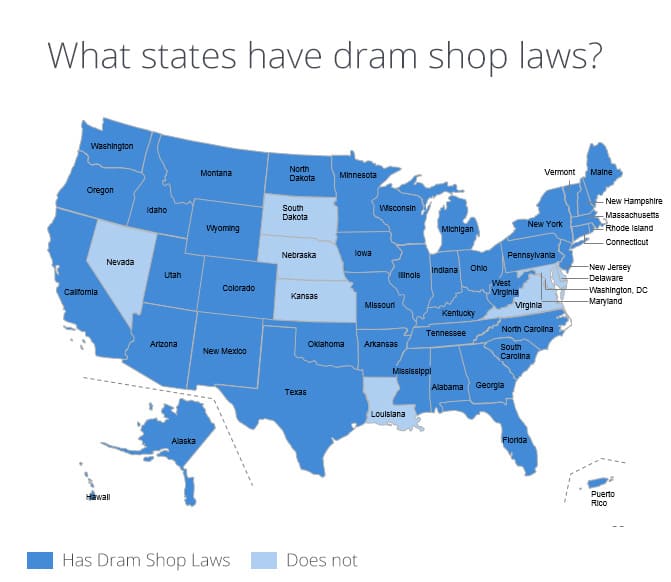

Dram shop laws, enforced in 43 states, hold a business owner liable if they, or their staff, serve a customer alcohol who is either a minor, or already clearly intoxicated. If the drunk customer later causes injury, or property damage, or death, the injured party could bring a claim against you.

The court could hold you liable for negligently, or recklessly, serving alcohol to a minor or to somebody who was visibly intoxicated.

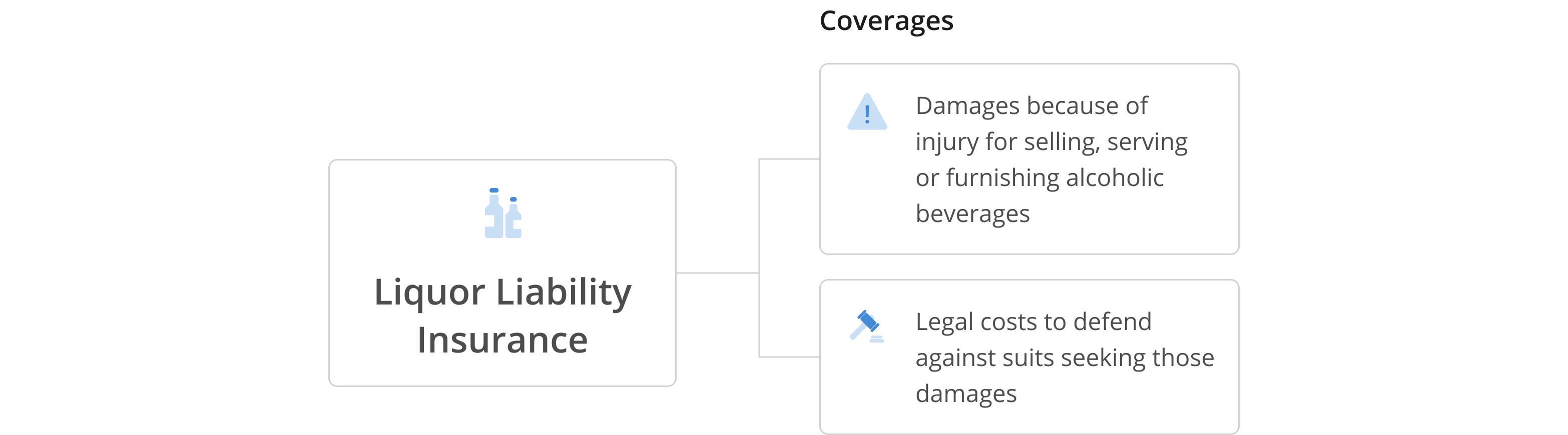

Liquor Liability Insurance will be needed if a claim is made against you in response to a dram shop law. It will cover your legal costs to defend the claim, and damages in the event of a court ruling against you.

What Liquor Liability Insurance For Restaurants Is All About:

What Does Liquor Liability Cover?

3 Easy Steps to Get Your Restaurant Insured Today

Talk to an expert in restaurant insurance

Speak with an experienced agent for expert advice to get your restaurant insured quickly.

Flexible payment options

Choose from multiple payment plans to insure your restaurant business today.

Download your insurance certificate

Get your Certificate of Insurance (CoI) within a day, and show everyone you're insured.

Frequently Asked Questions

Is it mandatory for a restaurant to hold liquor liability insurance?

“Dram Shop Laws” are enforced in 43 US states plus Washington DC. At the time of publication, the following states do not have Dram Shop Laws: Delaware, Kansas, Louisiana, Maryland, Nevada, South Dakota, and Virginia.

Regardless of whether Dram Shop laws are enforced or not, it is not mandatory for a business owner to hold Liquor Liability Insurance. However it will give you peace of mind knowing that you’ll be covered if you need it.

What is excluded from liquor liability insurance coverage?

Intentional acts: Liquor liability insurance generally does not cover claims that arise from intentional acts, such as assaults or fights that are initiated by a patron who has consumed alcohol.

Illegal activities: Liquor liability insurance does not cover claims that arise from illegal activities that occur on the premises, such as drug use or the sale of drugs.

Non-alcohol related incidents: Liquor liability insurance only covers incidents that are directly related to the service or consumption of alcohol. It does not cover other types of incidents, such as slip and falls, that may occur on the premises.

Unlicensed establishments: Liquor liability insurance may not cover claims that arise from establishments that are not properly licensed to sell or serve alcohol.

Employee claims: Liquor liability insurance generally does not cover claims that are made by employees who are injured while performing their duties. These types of claims may be covered under a workers' compensation policy.

Working with a knowledgeable insurance agent can be helpful in finding coverage for your restaurant's specific needs.

How is the premium for liquor liability insurance determined?

1. Sales Volume: The more alcohol a restaurant sells, the higher the premium will generally be for liquor liability insurance.

2. Location: The location of the restaurant can also affect the premium rate, as some areas may be considered higher risk for alcohol-related incidents.

3. Type of Alcohol Served: The type of alcohol served can also impact the premium rate, as some types of alcohol may be more likely to cause incidents or accidents.

4. Safety Measures: Safety measures, such as having trained bartenders, can help reduce the risk of incidents and may lower the premium rate for liquor liability insurance.

5. Claim History: A restaurant's claim history can also affect the premium rate for liquor liability insurance. A history of claims or incidents may result in higher premiums.

What steps can my restaurant take to reduce the risk of alcohol-related incidents and claims?

1. Train Employees: Providing training to employees, such as bartenders and servers, can help ensure that they are aware of responsible alcohol service practices, such as checking IDs and refusing service to customers who are visibly intoxicated.

2. Set Limits: Establishing limits on the number of drinks a customer can be served, as well as the time frame for service, can help prevent overconsumption of alcohol.

3. Monitor Customers: Monitoring customers for signs of intoxication, such as slurred speech or stumbling, can help prevent incidents from occurring.

4. Provide Alternative Options: Offering non-alcoholic beverages and food options can help encourage responsible consumption of alcohol.

5. Maintain Proper Licensing and Insurance: Ensuring that the establishment is properly licensed to sell or serve alcohol, and that the appropriate insurance coverage is in place, can help protect against claims arising from incidents involving alcohol.

What are the insurance covers that restaurant businesses like me usually get?