What Is Professional Liability Insurance?

Professional Liability Insurance covers your small business if a customer claims that the professional service you gave them caused them financial loss or harm.

When your disgruntled client seeks to recover their loss, they'll make a claim against you in court. Your professional liability will be decided by the court. If the court's decision is not in your favor, you may have to pay out a lot of money in damages, as well as the other side's legal costs, on top of your own!

Professional Liability Insurance covers all these costs if you lost a court action. This policy means that you will hang on to your funds to continue running and growing your small business.

We shop for you! Compare rates from +10 top carriers

What Professional Liability Insurance Is All About:

What Does Professional Liability Insurance Cover?

Frequently Asked Questions

Who Is Covered by Professional Liability Insurance?

You and Your Business Professional Liability protects you and your business if you make an error resulting in financial loss to a customer. If you have a partnership, LLC, or corporation all parties would be covered. Most policies will also insure claims made against a spouse for their work within the business.

Your Employees If you have employees that are providing the same professional services for a fee they will be covered under this policy as well. Keep in mind that subcontractors and volunteers are not always covered and you must check the policy to know.

Do I Need Professional Liability Insurance?

Professional Liability Insurance will come in handy if you:

- Want to protect yourself and your business against negligence claims.

- Want to protect yourself and your business against financial risk.

- Want to ensure your business assets are protected for now and for the future.

- Want coverage for anything that can go wrong with providing professional advice, services or products to customers or clients.

What Are the "Limits" on Professional Liability Insurance?

The standard limit for Professional Liability follows the market base of $1,000,000 per claim. As sales or company assets grow above $1M your company should start to consider higher limits.

It is also common for larger corporations to expect their professional services vendors to carry $5M or even $10M in Professional Liability limits. Often, to procure limits of this magnitude you will have to provide the customer contract requiring it.

The deductible/retention on these insurance policies can vary from $0 to 10% of the limit of insurance you carry, depending on your industry and insurance history.

What is professional liability insurance?

Professional Liability Insurance is one of the most common insurance types that business owners purchase. Professional Liability Insurance is also known as Errors & Omissions Insurance, due to the fact that it covers any errors or wrongful acts.

This insurance essentially protects businesses, as well as their workers or individuals, against claims made by clients regarding inadequate work or negligent actions.

Such negligent actions include mistakes made by either you or someone who works for you when attempting to provide a service. With Professional Liability Insurance, such actions would be covered and company losses would be accounted for.

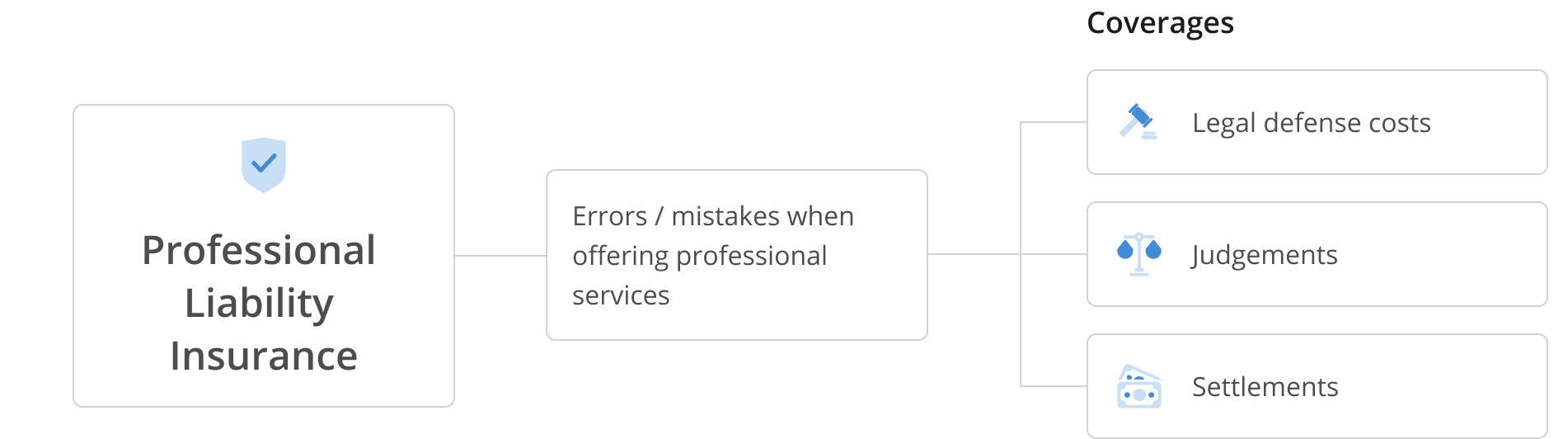

What does professional liability insurance cover?

Professional Liability insurance covers any errors or mistakes made by you or people who work for your business, while trying to provide a service. Such branches of coverage under this insurance policy would include legal defense costs, judgments, and settlements (or company losses).

Professional Liability insurance protects you, your business, and your business’s assets from financial risks in the event a client claims that you or an employee performed a service incorrectly.

Professional Liability insurance provides you with the protection you’ll need to maintain your business’s reputation after any claims or lawsuits.

What is a professional limited liability company?

A professional limited liability company (or PLLC) is generally a business that exists specifically for licensed professionals, such as lawyers, doctors, architects, engineers, accountants, and chiropractors.

Typically, these companies are formed to separate professional individuals from the entity and to ensure that the individual will not be personally held liable for the business’ debts or any lawsuits against the business that they are affiliated with.

It is important to note that a PLLC will not protect an individual in the event they were to be involved in some type of malpractice they committed themselves.

How much does professional liability insurance cost?

The cost for Professional Liability Insurance can vary in regards to the size of your business and the type of industry. Nevertheless, what determines the cost of this insurance overall is the amount of coverage your company is willing to pay for.

If your business decides to select a more basic, professional liability insurance plan, for example, then the cost will be less compared to a company that chooses a larger, more optimized insurance plan.

Quite often, if you own a small business, you can expect to pay between $1,000 to $3,000 annually per million dollars in coverage.

Who needs professional liability insurance?

It is generally recommended for any business which provides a service for a fee. However, if you have a business in the service industry, it is highly recommended you obtain this coverage.

A significant amount of businesses in the service industry typically purchase this insurance more than businesses in other industries.

Typically, Professional Liability Insurance is most commonly purchased and recommended for the following industries: IT/Technical, Legal, Architectural and Design, Finance and Accounting, Management Consulting, and Engineering Services.

How much professional liability insurance do I need?

How much Professional Liability Insurance you need depends on the type of industry your business operates within. Depending on your business’ industry, the types of Professional Liability protections you need will vary.

Additionally, the amount of Professional Liability coverage you need is dependent on a variety of other factors such as the size of your business, how many individuals you have employed, and types of equipment you have.

Also take into account the extent of coverage you may need for any products your business has and for the services it provides.

Is professional liability insurance the same as errors and omissions?

Technically, Professional Liability Insurance and Errors and Omissions (E&O) Insurance are the same thing. While both terms are interchangeable, depending on a certain industry your business is in, you may use one term over the other.

Generally, accounting, real estate, and tech professionals are familiar with the term Errors and Omissions Insurance, while architects and engineers are familiar with Professional Liability insurance.

However, both terms practically involve the same thing: coverage for claims over your services and for errors or mistakes made by you or employees of your business.

How much is professional liability insurance for consultants?

The cost of Professional Liability Insurance for consultants is dependent on how much coverage your consulting business needs. Typically, Professional Liability Insurance is issued in increments of $1 million.

Depending on the amount of coverage your consulting firm needs, your per-claim deductible can range from $1,000 to $25,000. Keep in mind that you should check your client contracts to ensure sure your insurance limit meets their specific requirements.

You’ll also want to adjust your plan based on the number of people you need to cover and the professional responsibilities that need coverage.

Is professional indemnity insurance the same as public liability?

Though similar in terms of coverage, Professional Indemnity Insurance and Public Liability Insurance have their differences.

While both types of insurance protect your business against legal action and compensation awarded to third parties, they are actually designed to offer different forms of protection in regards to your business activities.

Professional Indemnity typically covers legal liability for claims that arise out of an actual or alleged breach of one’s professional duties.

Meanwhile, Public Liability provides coverage for legal liability for claims of personal injury or property damage as a result of an event in relation to your business activities.

Is professional liability insurance the same as malpractice insurance?

Similar to the situation regarding Errors and Omissions Insurance, Malpractice Insurance and Professional Liability Insurance are generally the same thing.

As both terms are interchangeable, the term Malpractice Insurance is simply more familiar to medical professions, where medical malpractice is more of a common issue.

Meanwhile, the term Professional Liability Insurance is more familiar with architects and engineers. No matter which term you use, both insurances provide coverage over claims of negligence or mistakes made by you or a worker while attempting to perform a service.

What is professional liability insurance for consultants?

Professional Liability Insurance for consultants is coverage necessary to protect you against the risk of lawsuits claiming negligence in the professional delivery of your consulting work.

This insurance protects your consulting business in the event a client claims you or a worker provided incorrect work, made errors or oversights, or that your business failed to commit to professional duties.

The coverage also takes care of any court costs you may otherwise have to pay out-of-pocket and any settlements or attorney fees. This policy is intended to safeguard your consulting firm and provide coverage for unique risks typically associated with consulting businesses.

What is the purpose of professional liability insurance?

The purpose of Professional Liability Insurance is to protect business owners from third party claims of negligence and mistakes, made by yourself or by one of your workers, while providing a service.

Many professionals in various industries need and rely on this insurance to cover lawsuits, court settlements and any other court costs regarding such claims.

Professional Liability Insurance also helps businesses redeem themselves and recover their reputation. The purpose of this insurance is to protect you and your business against unwanted outcomes.

Why do I need professional liability insurance?

You need Professional Liability Insurance if you own a business that provides services or if you have a business in an industry where this type of insurance is most commonly purchased.

You may already have General Liability insurance for example, but if you want additional protection for the diverse risks commonly associated with Professional Liability, you’ll want this insurance.

Generally, most business could use this type of insurance, but service industries in particular should obtain Professional Liability since there is increased risk of malpractice or errors while performing a service; all incidents that would otherwise be unprotected.

Does umbrella insurance cover professional liability?

Umbrella Insurance offers additional liability coverage that many not be found or offered from a general liability policy. It is designed to fill in empty areas between existing policies and takes over when the coverage on your existing policies deplete.

The insurance does not inherently “cover” or take the place of professional liability, but rather acts as extra coverage or “support” for professional liability (as well as other policies).

In other words, Umbrella insurance can extend and go beyond the limit of your existing policy while also protecting you from bodily injury liability claims and even property damage liability claims.

Is professional negligence a tort?

Professional negligence is a breach of fulfilling a duty of care or a service correctly for your client.

In the English law, professional negligence is in fact a tort, or in other words, a wrongful act or an infringement of a right which leads to legal liability.

In professional negligence, the duty of care is a common law arrangement where the client expects an adequate level of professionalism and standards commonly held by those in the according profession.

When the arrangement to perform a duty of care is broken or breached by your business, then it is considered professional negligence, or a tort.

What are the elements of professional negligence?

Professional negligence include three key elements: a duty of care is owed by the professional; that duty is breached; and a loss is caused to the injured or affected party as a result of the breach.

It is important to note that a professional is only liable for their client’s loss (such as injury) if it is in accordance to their own failure of care which made them negligent.

In simpler terms, if the key elements of professional negligence are to be applicable to the professional, then there is a tortuous breach and the professional is then liable.