Best in class insurance partners

Why Do Restaurants Need a Business Owners Policy?

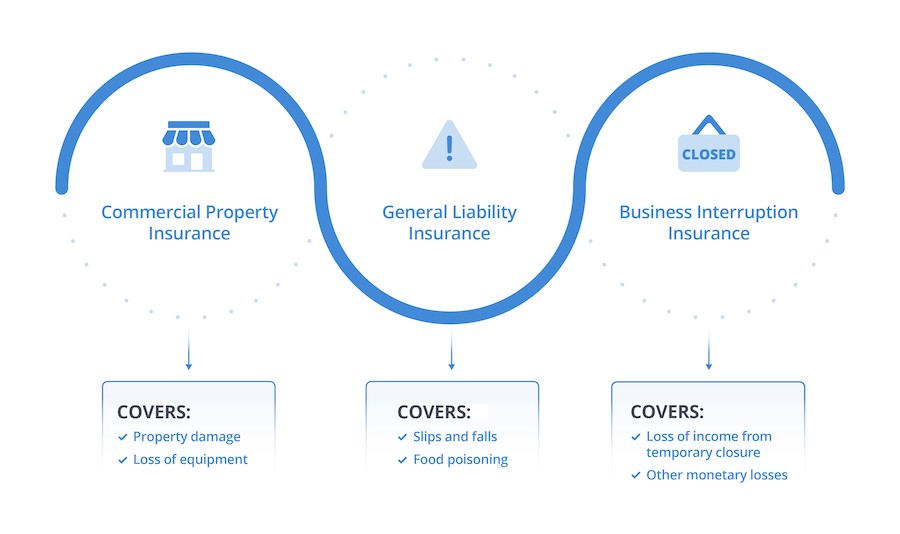

Business Owners Policy (or BOP) is a package that combines multiple insurance products under one policy. Products include Commercial Property, General Liability, and Business Interruption.

Commercial Property: Your restaurant premises are vulnerable to property damage or loss of equipment. This could occur as a result of a fire in the kitchen. Commercial Property Insurance can help your restaurant recover quickly after suffering property damage or loss.

General Liability: Slips and falls are common in restaurants, as is food poisoning. General Liability Insurance covers your restaurant when faced with claims from your customers of bodily injury. It can contribute to medical costs and legal fees.

Business Interruption: Your restaurant may suffer financial loss if a disaster forces you to close temporarily. Business Interruption Insurance supplements your business' income in the event of a covered loss.

What a Business Owners Policy For Restaurants Is All About:

What Does a Business Owners Policy Cover For a Restaurant?

3 Easy Steps to Get Your Restaurant Insured Today

Talk to an expert in restaurant insurance

Speak with an experienced agent for expert advice to get your restaurant insured quickly.

Flexible payment options

Choose from multiple payment plans to insure your restaurant business today.

Download your insurance certificate

Get your Certificate of Insurance (CoI) within a day, and show everyone you're insured.

Frequently Asked Questions

What’s The Benefit of Getting a BOP?

Why Do Restaurant Owners Typically Purchase a Business Owners Policy?

Business Owners Policy (BOP) is an essential coverage option for restaurant owners. It provides a comprehensive package of insurance coverages that can help protect their restaurant business from various risks and liabilities.

One of the main reasons why restaurant owners need a BOP is to protect their property and expensive equipment, such as ovens, refrigerators, and stovetops.

Another important coverage is for general liability, which helps protect your restaurant from lawsuits and other legal claims.

Additionally, a BOP can provide coverage for business interruption, which is essential for restaurants that rely on a steady flow of customers to stay profitable.

How Much Would I Pay For a Business Owners Policy For My Restaurant?

The cost of your insurance depends on your circumstances, including the size of your restaurant, its location, and the type of food you serve.

What Are The Limits Of a Business Owners Policy, And Is It Sufficient To Cover My restaurant's Assets In The Event of a Major Loss?

A BOP typically includes a limit for property damage, a separate limit for general liability coverage, and a separate limit for Business Interruption. The limits of coverage will depend on the value of the assets you want to insure and the level of associated risks.

To determine whether the limits of a BOP are sufficient to cover your restaurant's assets in the event of a major loss, as a restaurant owner, you should conduct a thorough assessment of your risks and needs. This may involve a review of your restaurant's property and equipment values.

Does a Business Owners Policy Includes Coverage For Food Spoilage or Contamination?

A Business Owners Policy (BOP) can include coverage for food spoilage or contamination.

However, it's important to note that coverage for these types of events may not be automatically included in all BOPs, so you may need to purchase additional coverage or endorsements to ensure you are fully protected in the event of a food-related incident.

It's also important for restaurant owners to take steps to minimize the risk of food spoilage or contamination, such as implementing proper food handling and storage procedures, maintaining clean kitchen and storage areas, and regularly inspecting and disposing of expired or contaminated food. This can help reduce the likelihood of a food-related incident and may help lower insurance premiums.

What Types of Events Are Excluded From Coverage Under a Business Owners Policy?

Intentional acts: Any damages or losses resulting from intentional acts, such as fraud or embezzlement, may be excluded from coverage under a BOP.

Employee injuries: Injuries sustained by employees while on the job are covered by workers' compensation insurance, which is separate from a BOP.

Auto accidents: Auto accidents involving company-owned vehicles are covered under a separate commercial auto insurance policy.

Floods: Damage caused by floods is typically not covered under a standard BOP. Businesses located in flood-prone areas may need to purchase additional flood insurance.

Cyberattacks: While some BOPs may offer limited coverage for certain types of cyberattacks, many policies exclude coverage for losses resulting from cybercrime. Cyber Liability insurance may be purchased as a separate policy.

Does a Business Owners Policy Cover Loss of Income Due to Business Interruption, And If so, For How Long?

A Business Owners Policy (BOP) can include coverage for loss of income due to business interruption.

In the event of a covered loss, such as a fire, business interruption coverage can help compensate the restaurant owner for lost income and additional expenses incurred as a result of the interruption in operations. This may include expenses such as rent, utilities, payroll, and other costs that continue even when the business is not operating.

The length of time that business interruption coverage will remain in effect will depend on the specific policy and the terms of coverage. Some policies may have a specific time limit, while others may provide coverage until the business is able to resume normal operations.

It's important for restaurant owners to carefully review their policy documents and work with their insurance provider to ensure that their business interruption coverage is adequate for their needs.

What are the insurance covers that restaurant businesses like me usually get?