Best in class insurance partners

Why Do Restaurants Need Cyber Liability Insurance?

Any kind of restaurant is constantly collecting sensitive data such as credit card numbers, and personal information about their customers like phone numbers and emails. Information about employees is also collected and might include bank accounts, social security numbers, and more.

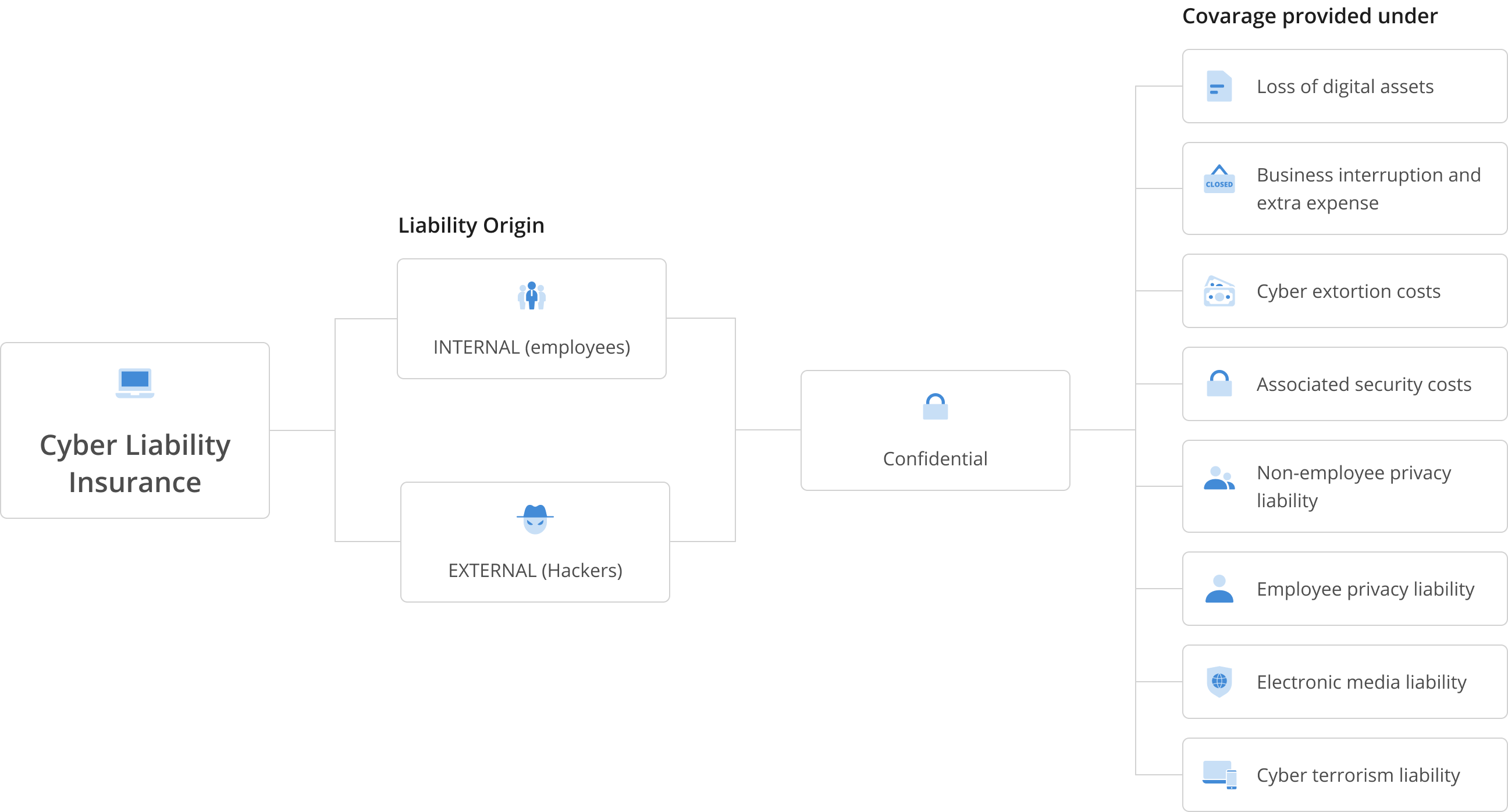

These are the reason why restaurants need cyber liability insurance to protect themselves from potential financial losses from cyber-attacks. Cyber attacks can lead to sensitive customer data breaches, system failure, and other cyber risks that can cause reputational harm and legal liabilities.

Cyber liability insurance for restaurants can help cover the costs associated with investigating and managing a cyber incident, as well as providing compensation for damages and losses incurred as a result of the attack.

Additionally, some POS providers for restaurants will require you to have this coverage to work with you.

Cyber Liability For Restaurants: What Should You Know?

What Does Cyber Liability Insurance Cover For My Restaurant?

3 Easy Steps to Get Your Restaurant Insured Today

Talk to an expert in restaurant insurance

Speak with an experienced agent for expert advice to get your restaurant insured quickly.

Flexible payment options

Choose from multiple payment plans to insure your restaurant business today.

Download your insurance certificate

Get your Certificate of Insurance (CoI) within a day, and show everyone you're insured.

Frequently Asked Questions

Is It Obligatory To Get Cyber Liability Insurance To Operate A Restaurant?

It is not mandatory by law for restaurant owners to obtain cyber liability insurance. However it will help protect a restaurant's reputation to rebuild trust after a cyber attack, particularly when this becomes public knowledge.

Affected customers will revisit your restaurant if their loss has been remedied, and future customers will trust you knowing that your cyber liability insurance will protect them too if they are affected by another breach.

If you want a POS, your provider may make it a contractual requirement to take out cyber liability insurance as a condition of obtaining their services.

What Does Cyber Liability Insurance Cover?

Cyber liability insurance may cover the high costs associated with investigating and mitigating the damage caused by a data breach. This could include the costs of notifying affected customers, defending any lawsuits, or paying any regulatory fines that may result.

Cyber Liability Insurance may also cover the loss of income due to system downtime, or other tech-related issues, caused by a cyber attack.

How Much Does Cyber Liability Cost?

Cyber liability insurance premiums for restaurants can range from a few hundred to several thousand dollars per year. The exact cost of cyber liability insurance for your restaurant will depend on several factors, including:

- The size and type of restaurant you’ll be operating.

- The presence or absence of security measures taken to prevent a cyber attack.

- How you collect and store personal data, and the amount of sensitive data stored.

- Your restaurant’s claims history.

It's essential that restaurant owners work with a reputable insurance provider to assess their specific risks and determine the best level of coverage you need.

How Can Restaurants Reduce Their Cyber Liability Risk?

Restaurants can reduce their cyber liability risk by implementing strong security measures such as:

- Using encryption and firewalls.

- Regularly backing up data.

- Training employees on safe digital practices.

- Conducting regular security assessments.

- Having a cyber incident response plan in place.

By taking these steps, restaurant owners can lower their chances of a cyber attack and potentially reduce their insurance premiums.

It's essential to prioritize cybersecurity in the restaurant industry due to the sensitive customer data that restaurants store, including credit card information. By reducing cyber liability risk, restaurants can avoid significant financial losses, reputational damage, and regulatory fines.

What are the insurance covers that restaurant businesses like me usually get?