What Is Workers Compensation Insurance?

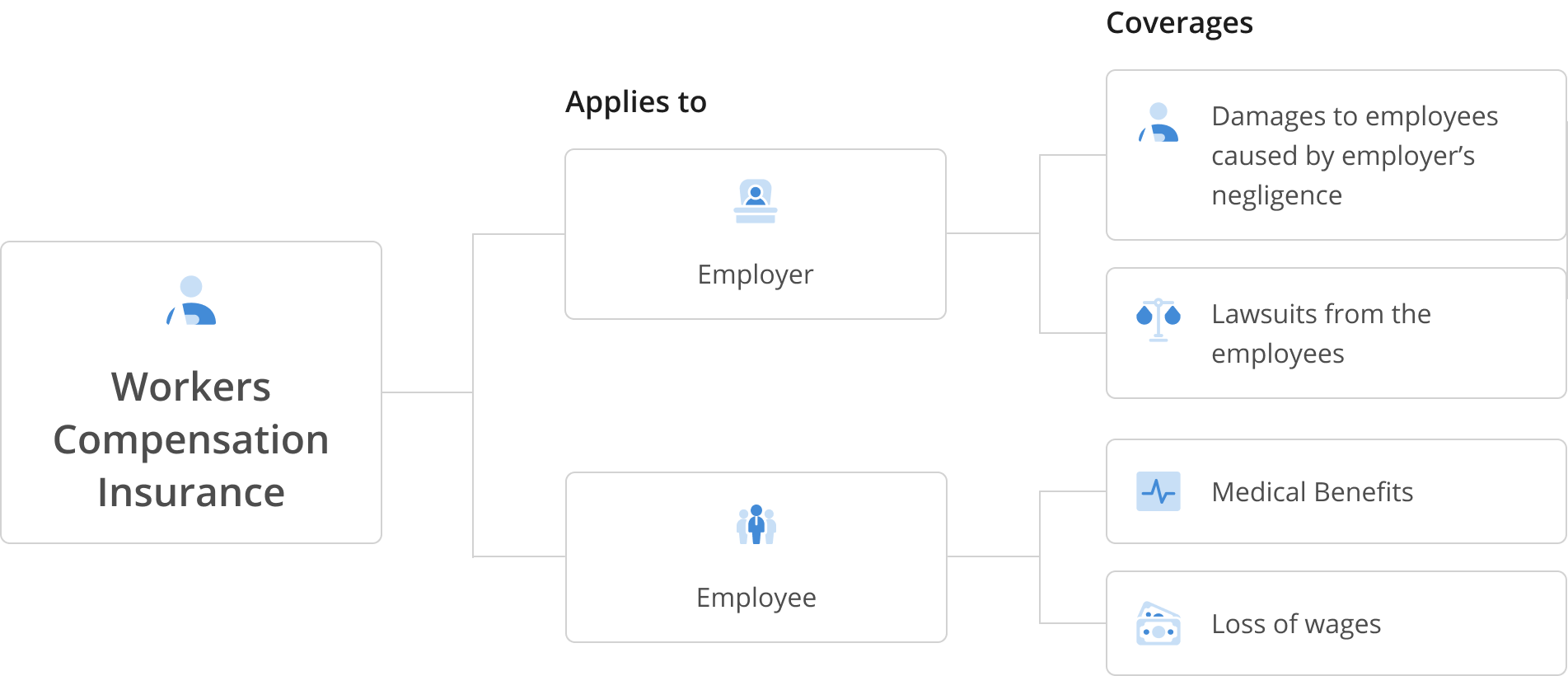

Often called “Workman’s Comp,” this insurance covers the occurrence of employee injuries. It provides wage replacement and medical benefits to employees who are injured at work.

In exchange, employees relinquish their right to sue their employer for negligence. Therefore, Workers Compensation Insurance protects employers from costly lawsuits while also assuring employees that they are guaranteed some coverage in case of illness or injury on the job.

Best in class insurance partners

What is Workers Compensation all about?

What Is Covered Under Workmen Compensation Insurance?

Frequently Asked Questions

What Are the “Limits” on a Workers Compensation Payout?

There is no federal limit to the amount that can be paid to an injured employee. Instead, the amount is determined by the Workers Compensation Board in each state.

However, employer liability coverage in Workers Compensation cases does have a limit. Basic policy limits required by law range from $100,000 per employee for bodily injury to $500,000.

In some states, laws also limit the amount an injured employee can recover from an employer, and eliminate the liability of co-workers in most accidents, protecting both employers and fellow workers.

When can an employee make a Claim?

An injured employee can make a claim under your company’s Workers Compensation Insurance policy if their injury were sustained either in the workplace, or in the “course and scope” of their employment.

A deceased’s employee’s dependants can make a claim if the deceased, your former employee, was killed in a work-related accident or illness.

What Does Workers Compensation Insurance NOT Cover?

1. Injuries incurred while not on the job

This insurance only covers injuries that happen on the job, so anything that happens to employees when they are off the clock or not performing official duties likely won’t fall under this policy. For example, if a employee is injured during their personal time, such as during a gym session or over the weekend when they’re not required to be working, they won’t be covered.

2. Self-inflicted injuries

While some employees have argued to expand coverage because they are always working or thinking about work, courts have enforced common sense limits. For example, if your employee falls out of bed because they are having a work-related nightmare, their injuries will not be covered.

3. Negligence

General damages for pain and suffering, and punitive damages for employer negligence, are generally not available under this type of insurance claim. Negligence is generally not an issue in these cases.

4. Injuries incurred as a result of violations of company policy

Workers Compensation laws are designed to give employers immunity from liability above the amount provided by their policies. However, in some states, an employer can still be held liable for greater amounts if the claimant can prove they recklessly or intentionally caused them injury, harm or illness. In other states, while employers might be immune, third parties like subcontractors or machinery manufacturers may face liability. This also applies when injuries happen while an employee is committing a crime.

5. Permanent and stationary injuries

Workers Compensation Insurance covers injuries or illnesses until they become permanent and stationary. Then, employees may be entitled to permanent disability benefits and lifetime medical care.

If I use contractors, do I still need Workers' compensation insurance?

Contractors and volunteers may be eligible for workers' compensation benefits if they are hurt or fall ill on the job, depending on the state. If you employee contractors, consult with a CoverWallet advisor.

What factors influence my Workers’ Compensation premiums?

The 3 main factors that influence your premiums include:

- Payroll: How much your employees earn

- Risk: The jobs your employees are performing and their level of risk.

- History: Past claims history

What are Workers Compensation class codes?

Class codes are determined based on the employee's job duties, such as a concrete worker or clerical office employee. This will determine the rate per $100 of payroll that you will have to pay for the Workers Compensation coverage.

What is Workers Compensation Insurance loss cost?

Loss cost is the name given to the method used by an insurance company to determine the rates for each class code. Loss cost is the number of medical losses for each claim.