Best in class insurance partners

Why Do Restaurants Need Commercial Auto?

As a restaurant owner, you understand that transportation plays a significant role in your business. Whether it's delivering food to customers, transporting catering equipment, or picking up supplies, your vehicles are essential to keeping your restaurant running smoothly. However, with the increased use of vehicles, the risk of accidents and other mishaps also rises. That's where commercial auto insurance comes in.

Commercial auto insurance provides coverage for vehicles used for business purposes, including liability coverage for damages caused by your business vehicles. This type of insurance can protect your restaurant from the financial risks associated with accidents, theft, or damage to your vehicles. Without commercial auto insurance, you may be responsible for the full cost of repairs, medical bills, and legal fees resulting from accidents or other incidents.

Commercial auto insurance is a crucial investment for any restaurant owner with vehicles used for business purposes. By protecting your business from financial risks, you can focus on what you do best - providing your customers with delicious food and excellent service.

What is Commercial Auto Insurance For Restaurants All About?

How Does Commercial Auto Protect My Restaurant?

3 Easy Steps to Get Your Restaurant Insured Today

Talk to an expert in restaurant insurance

Speak with an experienced agent for expert advice to get your restaurant insured quickly.

Flexible payment options

Choose from multiple payment plans to insure your restaurant business today.

Download your insurance certificate

Get your Certificate of Insurance (CoI) within a day, and show everyone you're insured.

Frequently Asked Questions

What types of vehicles are covered under commercial auto insurance?

Commercial auto insurance covers a wide range of vehicles that are used for business purposes, including those used by restaurants. Vehicles that are commonly covered by commercial auto insurance for restaurants include delivery trucks, catering vans, and company cars used by employees for business purposes.

It's important to note that personal vehicles used for business purposes may not be covered by commercial auto insurance, and restaurant owners should consider requiring employees to use company-owned vehicles for business purposes to ensure adequate coverage.

By ensuring that all business vehicles are covered by commercial auto insurance, restaurant owners can protect their businesses from financial risks associated with accidents or other incidents involving their vehicles.

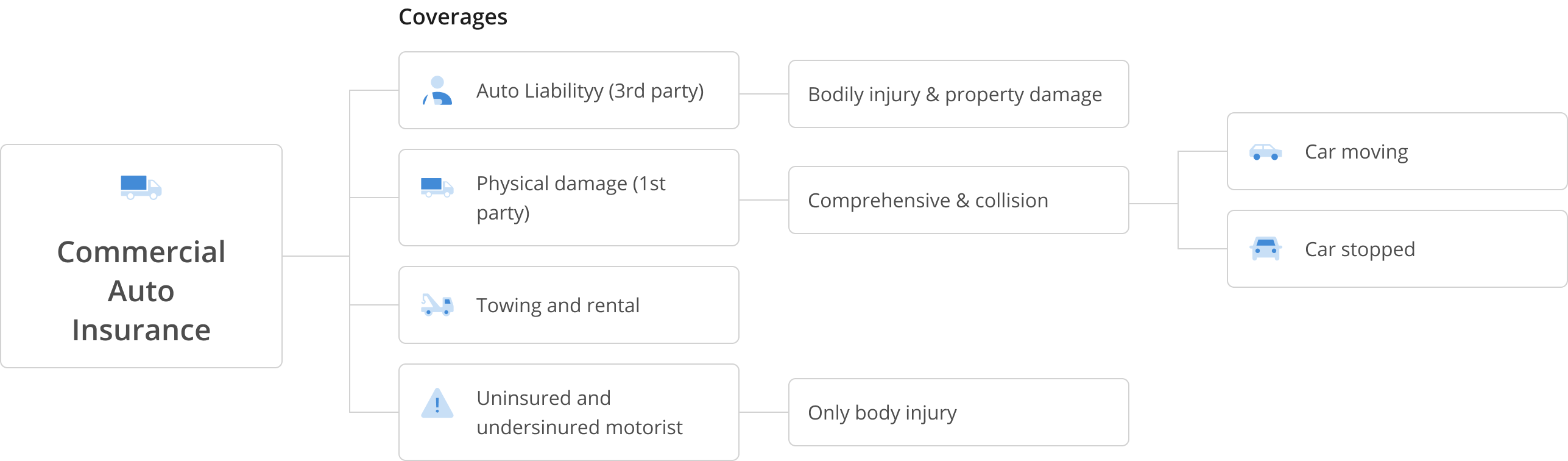

What types of coverage are included in commercial auto insurance?

Commercial auto insurance for restaurants typically includes a range of coverage options, including liability coverage, collision coverage, and comprehensive coverage. Liability coverage is required by law and covers damages and injuries to other people and their property if your business vehicle is involved in an accident.

Collision coverage covers damages to your business vehicle resulting from a collision with another vehicle or object, while comprehensive coverage covers damages from non-collision events, such as theft, vandalism, or weather damage.

Additionally, restaurant owners can choose to add additional coverage options, such as uninsured/underinsured motorist coverage, which can protect against accidents involving drivers who do not have adequate insurance coverage.

By selecting the appropriate coverage options for your restaurant's business vehicles, you can protect your business from financial risks associated with accidents or other incidents.

How is the cost of commercial auto insurance determined for my restaurant?

The cost of commercial auto insurance for restaurants is typically determined based on several factors, including the type of business vehicles being insured, the driving records of employees who will be operating the vehicles, the location and use of the vehicles, and the desired coverage options.

Other factors, such as the number of miles driven and the history of claims, can also affect the cost of insurance. Restaurant owners can often save money on commercial auto insurance by selecting higher deductibles, bundling coverage options, and implementing risk management strategies, such as driver safety training programs.

It's important for restaurant owners to shop around for commercial auto insurance quotes and compare coverage options. It is always a great idea to have the support of an experienced insurance agent expert in the restaurant industry.

What happens if my restaurant's business vehicle is involved in an accident?

If your restaurant's business vehicle is involved in an accident, you should immediately ensure the safety of all individuals involved and seek medical attention if necessary. The accident should be reported to the restaurant owner or manager and the insurance company as soon as possible.

Your commercial auto insurance should cover the cost of damages and injuries resulting from the accident, including medical expenses, property damage, and liability claims. It's important to gather as much information as possible about the accident, including the names and contact information of all individuals involved and any witnesses.

Your insurance company will then investigate the accident and determine the coverage and compensation you are eligible for.

What is the difference between collision and comprehensive coverage?

Collision coverage is a type of commercial auto insurance that covers damages to your business vehicle resulting from a collision with another vehicle or object, regardless of who is at fault.

Comprehensive coverage, on the other hand, covers damages to your business vehicle resulting from incidents other than a collision, such as theft, fire, or weather-related events. Comprehensive coverage is typically more comprehensive and therefore more expensive than collision coverage.

As a restaurant owner, you may want to consider both types of coverage to ensure that your business vehicles are adequately protected against all possible risks. It's important to carefully review your commercial auto insurance policy and discuss coverage options with your insurance agent to determine the best coverage options for your specific needs and budget.

Can I add additional drivers to my commercial auto insurance policy?

Yes, as a restaurant owner, you can typically add additional drivers to your commercial auto insurance policy.

This is important to ensure that all employees who will be driving business vehicles are covered by insurance in the event of an accident or other incident.

However, adding additional drivers to your policy may increase your insurance premiums. It's important to carefully consider the driving records and experience of all employees who will be driving business vehicles and ensure that they are properly trained and licensed.

You should also review your commercial auto insurance policy to ensure that it provides adequate coverage for all drivers and risks associated with your restaurant's operations. If you have any questions or concerns about adding additional drivers to your policy, you should contact your insurance provider for guidance and assistance.

What happens if an employee gets into an accident while driving their personal vehicle for business purposes?

If an employee gets into an accident while driving their personal vehicle for business purposes, your restaurant may still be held liable for damages and injuries resulting from the accident. In this situation, your commercial auto insurance policy may provide coverage for these damages and injuries.

However, coverage may vary depending on the circumstances of the accident and the terms of your policy. It's important to ensure that all employees are aware of the risks associated with using their personal vehicles for business purposes and that they have adequate insurance coverage.

Your restaurant may also want to consider implementing a policy that prohibits employees from using their personal vehicles for business purposes or provides additional compensation or benefits for using a company-owned vehicle.

What are the insurance covers that restaurant businesses like me usually get?