What Is Surety Bond Insurance?

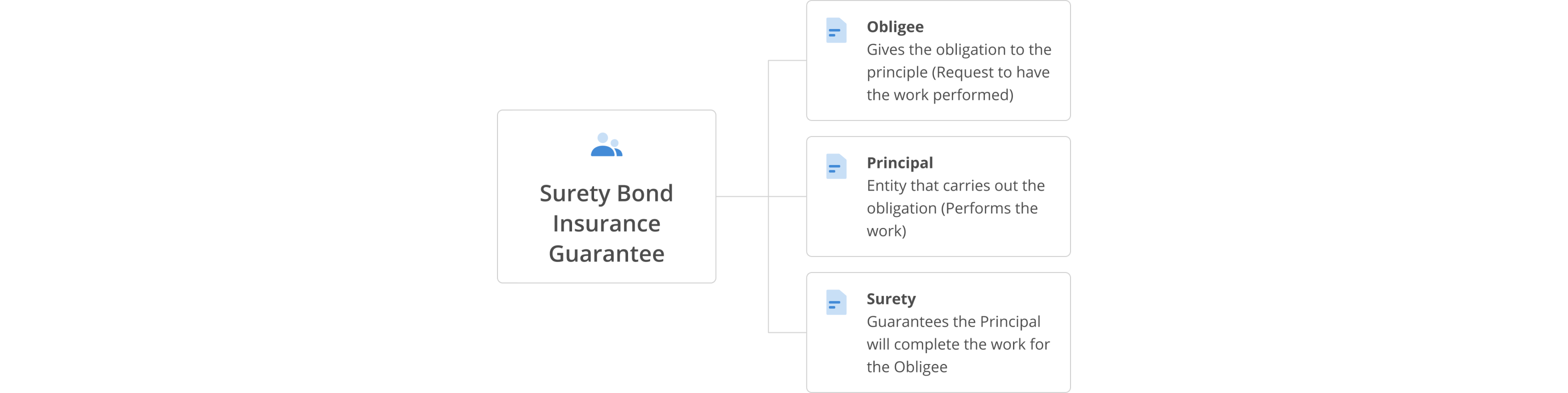

A Surety Bond involves a contract between three different parties:

Obligee - who provides the obligation to the Principal for completion.

Principal - who carries out the obligation

Surety (the Insurance Company) - who ensures that the Principal will carry out the obligation.

Surety Bonds Vs Insurance Policies: Difference?

-

Surety Bonds include a three party risk transfer.

-

Insurance policies include a two party risk transfer. (The insured person transfers risk to the insurance provider.)

If you want to hire a contractor in your small business operations, Surety Bond Insurance will cover all three of you.

We shop for you! Compare rates from +10 top carriers

What a Surety Bond Is All About:

What Does a Surety Bond Cover?

Frequently Asked Questions

Who is covered by the Surety Bond Insurance?

- Principal The Principal of a surety bond is the party that agrees to fulfill their contractual obligation of service to the obligee, or in other words probably you. If you are on this page the chances are that you were required by someone to obtain a surety bond.

The Principal can be any business from a contractor to a janitor to an individual doing a one-time deal. You are usually required to obtain a surety bond by someone who wants to make sure they don’t lose money by your business not fulfilling its contractual duties.

- Obligee The obligee is usually the reason the surety bond is needed, as they are requiring it usually for peace of mind. They want to be guaranteed that the Principal is going to fulfill all of their obligations that are required by whatever license they have or contract they signed.

For example, if a contractor bids on a job and signs a contract saying they will do XYZ and they default on that contract, the surety bond will make sure to pay back any financial investment made by the obligee.

- Surety The surety is the actual insurance company that is providing the bond. Of course, there is a pretty rigorous underwriting process in order to get approved for a bond since the surety is making a financial guarantee on your behalf.

Do I Need a Surety Bond?

Surety Bond insurance will come in handy if:

- You are a business owner and live in a state which requires you to obtain a bond in order to legally operate.

- You are an independent contractor and want to provide the obligee with a guarantee that you will carry out your contractual obligations.

- You are required by law to obtain a bond as part of a specific permit or license to enter a certain profession or carry out a certain type of work.

- You are seeking to build relationships with customers.

- You have an estate or administration that you need handled by another individual or group and want protected.

- You have money or assets that you need handled by another individual or group and want protected.

- A legal guarantee is required for a public official or court system.

What Are the “Limits” on a Surety Bond Insurance Policy?

A surety bond is a more of a guarantee than an insurance policy. A guarantee is a three party risk transfer in which the primary transfers risk to the surety for the failure of the obligee to carry out their contractual obligations.

By contrast, an insurance policy is a two party risk transfer in which the party being insured transfers risk to the insurance provider.

Knowing the difference between a bond and an insurance policy is important when determining what protection best suits your needs. Whereas insurance policies operate with the expectancy of loss, bonds do not.

Instead, bonds simply emphasize that contractual obligations will be carried and if not, financial loss will be recovered for the obligee.

What Surety Bond Insurance Is Not

A Surety Bond is not like insurance which reimburses your business for a loss, covers your liability, or pays for your defense costs. The bond guarantees that you will complete the job or services you agreed to provide, and It will pay the party requesting it if that doesn't happen.

Is a Surety Bond the same as insurance?

No, insurance is designed to provide protection against losses that may be expected as part of your business operations. A Surety bond is not expecting a loss, as they just guarantee you will complete your work. The Surety company will make sure your business is honorable before issuing one.

How much does a $100,000 Surety Bond cost?

The premium you will pay for a Surety bond can vary greatly and is often based on your credit score. Those with good or excellent credit scores will pay much less for a bond than someone with a bad credit score.

Additionally, the type of business you are in will influence the price as well, with riskier professions paying more.

How Much Does a Surety Bond Cost?

Generally, the cost of a surety bond is a percentage of a total amount that is paid to a surety for a guarantee. However, every bond is different and the cost depends on the specific circumstances of the relationship in question.

For every relationship, there are varying degrees of risk that must be taken into careful consideration. For example, a taxi driver may require a special license or permit to operate or a taxi company may be required by law to purchase a standard bond for its drivers.

The surety bond will likely take into account financial liability to both the company and driver as well as the communities they operate in. Through a bond, a taxi company can protect itself against financial obstacles which may arise as a result of the actions of drivers.

Additionally, a taxi driver can demonstrate to a taxi company that they wish to work with that they will carry out their contractual obligations. Without a bond, both a taxi company and driver could face significant financial hurdles and damages to their reputation.

Taxi services are often highly regulated and in some states, new drivers are required by law to first purchase a specific license or permit in order to operate.

A permit may include a surety bond that protects taxi drivers and/or companies upwards of, for example, $100,000 USD. If the bond has a 1% rate for $100,000 USD coverage, it would cost a taxi driver $1000 to obtain the permit or license.

Rates and coverage vary depending on the type of work being carried out, the relationship between obligee and primary as well as the financial risks involved in the agreement.