What is Liquor Liability Insurance?

Liquor Liability Insurance protects a small business that manufactures, sells or serves alcohol. Small business owners are protected from claims that occur when a customer drinks too much and injures himself or someone else.

Without Liquor Liability Insurance, owners of restaurants, clubs, taverns and bars that serve alcohol could end up footing the bill for damages made by an drunk customer.

For example, you could be sued if someone drinks at your bar and then goes on to cause an accident, damage property or cause injury to themselves or others.

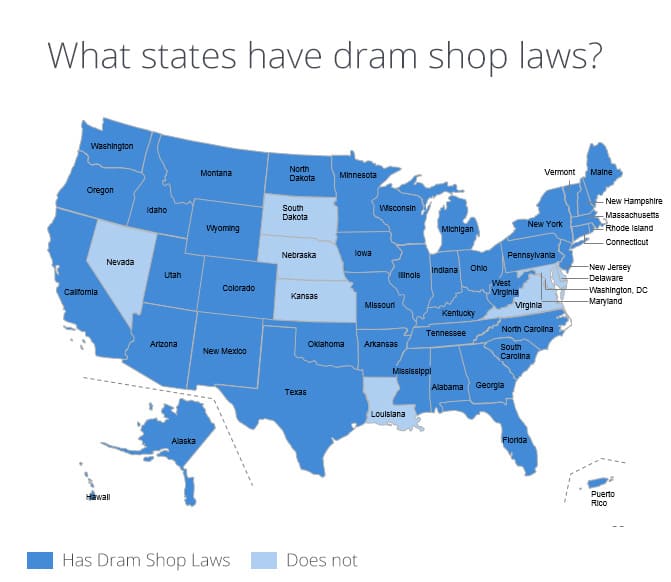

“Dram Shop” laws, enforced in 43 states, make a business owner liable if they or their employee were to serve a customer alcohol who is already clearly intoxicated.

Dram Shop laws make it more likely that you'll be sued if one of your overserved customers causes harm to someone else.

There are several ways that your business could be harmed if you serve alcohol but do not have a Liquor Liability Insurance policy:

- A customer leaves your bar or restaurant and then causes a driving accident. You could be sued for property damages and bodily injury, even if you were not directly involved in the motor accident.

- A customer gets into a fight outside your bar or restaurant after drinking at your establishment. You could be sued by one or both parties for bodily injuries.

We shop for you! Compare rates from +10 top carriers

What Liquor Liability Insurance Is All About:

What Does Liquor Liability Cover?

Frequently Asked Questions

Who Is Covered by Liquor Liability Insurance?

Your Business - Alcohol is a risky business, although very profitable. Your business will be protected against claims involving individuals under the influence of alcohol, such as if someone you served is in an accident and hurts someone or causes property damage to property or an outside party.

What Are the “Limits” on a Liquor Liability Policy?

The limits of your policy will vary based on your preferences and any legal requirements in your state. Every business is unique, so the amount of coverage you choose will depend on your personal comfort levels with risk, your annual sales and a variety of other factors.

While this type of insurance can protect you from many disasters with your alcohol-consuming patrons and their potential victims, it is not the only insurance you’ll need to ensure that you are covered.

In addition to helping you find the best policy, we can help you find what your company may be missing.

How Much Does Liquor Liability Insurance Cost?

The cost of this policy will depend on your business size, the amount of protection you want and any state required limits you’ll need to meet.

The best way to to get a true idea of cost is to get a quote specifically for your business and to review it carefully to make sure all of your concerns are truly covered.

Do I Need Liquor Liability Insurance?

This insurance comes in handy if your business:

- Is mandated by your state to carry this form of coverage

- Is required by your bank or financial institution to carry this form of coverage

- Serves alcohol at your hotel, B&B, café, restaurant or bar

- Serves alcohol at your business event or party

- Offers catering services that include alcoholic beverages

- Owns a facility that can be rented out for parties, events or weddings

- Runs fundraisers or special events that include alcoholic beverages on site or a bar (paid or open)

Do Caterers need Liquor Liability insurance?

Catering can be a very rewarding career as most people love food, and it is a comfort to many. Often, special events require catering and with that comes the request for serving alcohol.

While it is a very lucrative service to offer, it is important that you have the proper insurance coverage to cover the unique risks involved with serving alcohol to guests.

Lawsuit is a scary word, but a very real possibility since an intoxicated guest can cause many different issues. Someone who is over-served alcohol can start a fight and cause bodily harm to another person, or cause a ruckus and damage some property at the venue where the occasion is held.

Unfortunately, some people still drive while they are under the influence of alcohol. Best case scenario, they make it home with no incidents, but they could crash into someone’s building, another car, or God forbid another person.

If a lawsuit is brought against you if any of these unfortunate events happen, you will be responsible for any judgments, settlements, legal fees, and court costs.

For this reason alone, Liquor Liability insurance is worth having, as these fees can add up quickly, costing you tens of thousands of dollars.

Does dram shop liability insurance protect the seller of alcohol?

Yes, Liquor Liability is often referred to as dram shop liability as it protects bars, restaurants, and any other business that is serving, selling, or manufacturing alcohol.

Does a liquor store need Liquor Liability Insurance?

Absolutely. A liquor store is in the business of selling alcohol and therefore still has liability associated with it if the purchaser should become too intoxicated and cause damages, whether harm to someone or something else.

What is the difference between host Liquor Liability and Liquor Liability?

Host Liquor Liability insurance is usually part of your General Liability policy and is designed to protect a business from damages from an intoxicated guest who was served alcohol at an event hosted by you.

This usually applies when you are having third parties come in to serve their own alcohol. Liquor Liability is a completely separate policy and is for those businesses that manufacture, sell, or serve alcohol.