What Is General Liability Insurance?

General Liability Insurance covers your business when faced with claims of bodily injury, associated medical costs and damage to property that occurred as a result of your business operations.

We shop for you! Compare rates from +10 top carriers

What General Liability Insurance Is All About:

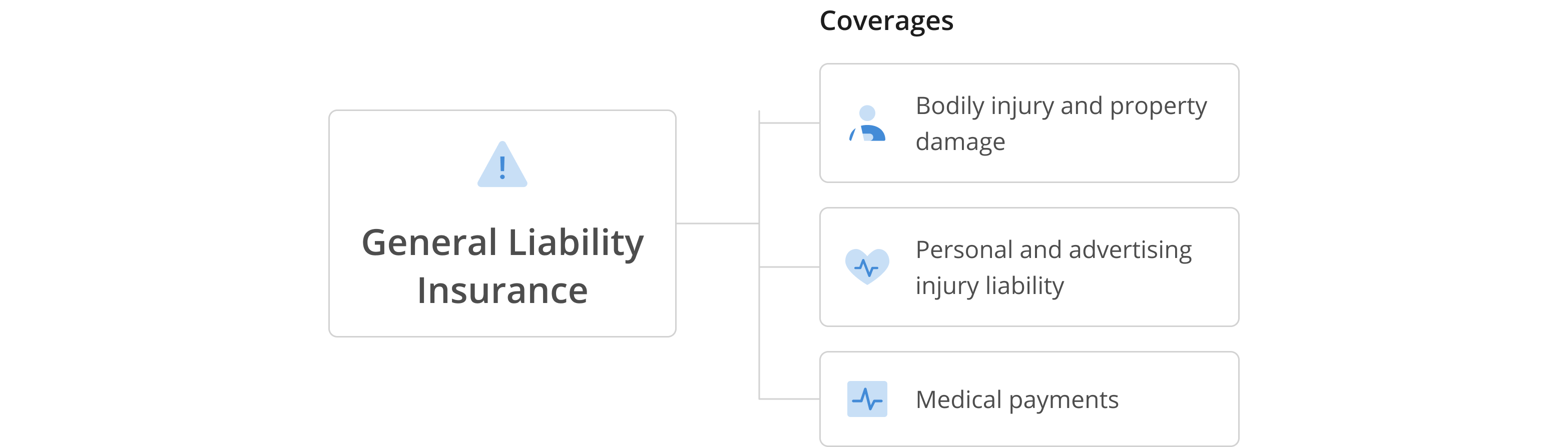

What Does General Liability Insurance Cover?

FAQs on General Liability

Do I Need General Liability Insurance?

Almost every business owner or independent contractor can benefit from having this insurance. However, if you’re still asking if it’s necessary, here are some reasons you might need coverage:

- You or your employees visit client's offices, or host clients at your work space

- You represent your client’s business

- You use third-party locations for any business-related activities

- You use a client’s equipment

- Your customers require you to have it (many companies require proof of coverage before they will enter into a contract or begin a business relationship with you, often requiring a minimum level of coverage)

How can I get General Liability insurance?

It's easy to get General Liability cover for your business by providing a few simple details about your business, such as location, nature of business and contact details.

You can get a quote within minutes with a few clicks of a mouse. If there are any question during the application a personal CoverWallet insurance advisor get in touch with you to discuss the details of your quote.

What is General Liability insurance for contractors?

General Liability Insurance for independent contractors is very much the same as for standard businesses.

If you are an independent contractor, it is likely you will be working with customers or clients and this carries the same risks concerning bodily injury and property damage regardless of the field you are working in (from IT to construction).

This insurance will also cover you against delays in completing work due to issues such as inclement weather.

General Liability Insurance is an important consideration for contractors and many businesses now ask for a Certificate of Insurance before they subcontract work out.

Is General Liability insurance required by law?

Liability insurance of some kind is mandatory for most types of business. General Liability Insurance is the most common form opted for by most businesses as it covers against the key risks.

You will need this insurance if you have clients or customers at your workspace, if you use third-party locations for business purposes or if you handle a client's equipment.

If you are working on a contract, a Certificate of Insurance may be required. Some businesses choose to combine General Liability Insurance with Commercial Property Insurance in a Business Owners Policy.

How much general liability insurance do I need?

Your coverage needs will depend on a number of factors. Firstly, your type of business. Some industries are more prone to risks, so for example a building contractor will need more coverage than a web designer. Secondly, the size of your business.

A busy restaurant in the city centre will need more coverage than a small rural cafe. Thirdly, your location is a factor as some states tend to award more in damages than others.

Most small businesses opt for coverage limits of $1-2 million. If your business is in a low risk category, it might be worth considering the Business Owners Policy.

What Are the Limits of General Liability cover?

Like most insurance plans, this type of policy will clearly outline its limit, or the maximum amount the insurance company will pay against a liability claim. It’s important to assess your risk carefully to ensure you have adequate coverage and won’t be left paying for expenses out of pocket.

Most General Liability insurance policies cover up to 1 million per occurrence and 2 million in aggregate, if you need additional coverage it is common to double the limits. If you need more than 2 millions per occurrence you most likely have to purchase an umbrella or excess insurance policy.

For example, if your small business is sued for__ $300,000 in medical costs__ associated with a slip-and-fall injury, but your policy limit is $250,000, you will have to cover the difference of $50,000 yourself. It is important to research your industry research before investing in a policy.