What Is Employment Practices Liability Insurance?

Employers liability insurance protects your company from financial losses in the event that an employee or a third party sues you for a work-related accident, illness, or death.

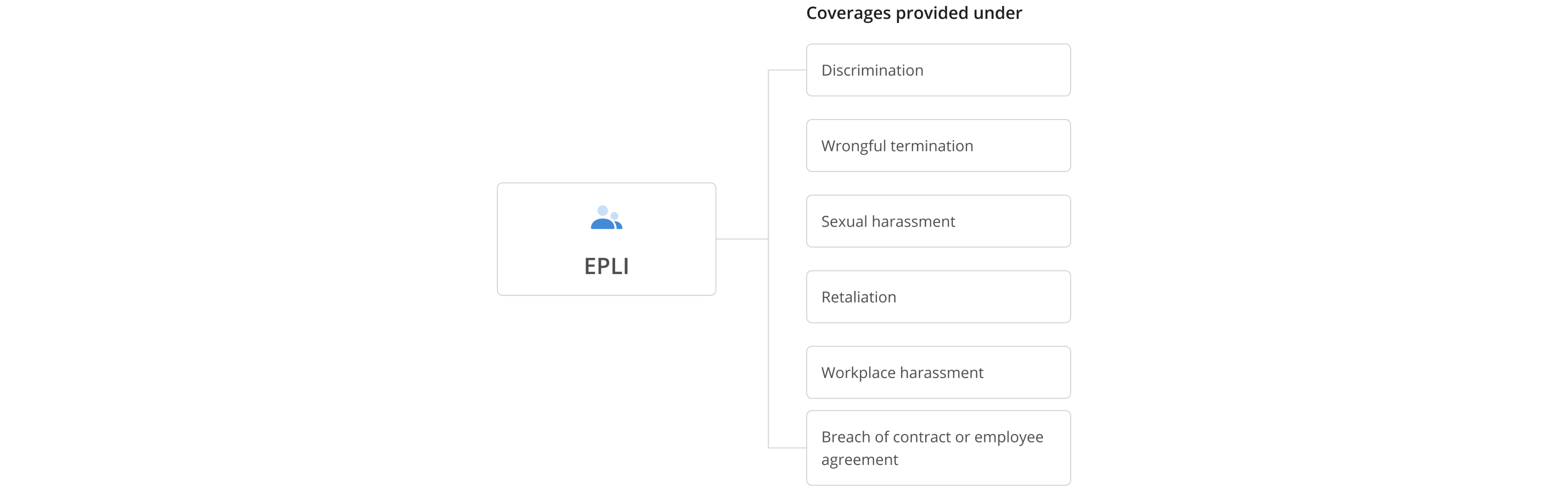

Aon can assist you in obtaining employment practices liability insurance (EPLI), which covers claims of discrimination (based on sex, race, age, or disability), wrongful termination, harassment, and other employment-related issues brought by employees.

If you don't have this form of insurance, you'll have to pay for the costs of the case out of pocket. After a major accident, this could result in a considerable financial loss.

We shop for you! Compare rates from +10 top carriers

What Employment Practices Liability Insurance is All About:

What Does Employment Practices Liability Insurance Cover?*

Frequently Asked Questions

How Much Does EPLI Insurance Cost?

Depending on the state, EPLI insurance coverage can cost $1,500 or less per year for $1M in liability coverage if your business has 5 or less employees.

Instead of evaluating the cost of an EPLI insurance policy, it’s wise to consider the cost of NOT getting one. Consider these 3 statistics to help you make the right decision:

- A startup with 1 founder typically generates around $ 120,000 per year (Source).

- EPLI insurance coverage can cost $1,500 or less per year - around 1.2% of your annual turnover.

- An EPL court settlement can cost $75,000 per lawsuit - around 62.5% of your annual turnover.

What EPLI Insurance is not

Sometimes when you hear the words Employment Practices it may be easy to assume that it has something to do with Workers Compensation. This is not the case.

Employment Practices only covers your liability associated with claims by employees for discrimination, harassment, wrongful termination, etc.

If your employees are injured and need lost wages, medical, or sue you for negligence, that is covered under Workers Compensation and Employer’s Liability.

What is 3rd party EPLI?

Third-party EPLI is available coverage that will reimburse your business for settlements, judgments, and defense costs associated with claims of discrimination and harassment.

This is necessary if you meet with clients, vendors, or any third-party that frequents your business. An example would be if the mailman gets catcalled by an employee and sues the business.

Does EPLI insurance cover wage and hour claims?

While most EPLI policies do not automatically cover wage and hour claims, such as failure to pay for overtime, it is usually available to add by endorsement.

The wage and hour claim endorsement will have a separate sublimit from the EPLI limit, and only covers the defense costs associated with the claim, no judgments or settlements.

Who needs employers liability insurance?

Employers liability insurance is required by every company that wants to avoid a large financial loss as a result of a work-related injury or disease. Accidents happen, even if you have strict safety standards in place.

In 2018, private enterprises in the United States reported 2.8 million nonfatal occupational injuries and illnesses, as well as 5,250 workplace fatalities.

If you're not properly insured, a single mishap might have a significant financial impact.

Employers liability insurance is typically included in nearly all standard workers' compensation plans in most states, so if you already have one, you're probably covered.

How do I get employer’s liability insurance?

Most workers' compensation contracts contain liability insurance for the employer. Employers in monopolistic states, on the other hand, will have to buy it individually from the state-run fund:

- North Dakota

- Ohio

- Washington

- Wyoming

If you live in one of these states, you can obtain this policy through private insurance as stop gap coverage to protect yourself from employee lawsuits.

How much does employer’s liability insurance cost?

The cost of employer's liability insurance is determined by your company's size and history of workers' compensation claims.

Insurance companies will evaluate your payroll expenditures and employee classifications when determining your rate (i.e. what kind of work your employees do). Businesses save money when their employees’ salaries are lower, when they haven't been harmed or fallen ill given the low level of risk inherent in their job tasks.

If you've never filed a workers' compensation claim, you'll probably save money on an EPLI policy.

If your company has significant payroll costs or other hazards, you may need to add commercial umbrella insurance to your business insurance policy. Umbrella insurance raises your policy's maximum amount, allowing your insurer to cover more expensive disputes.

What’s the difference between EPLI insurance and employment practices liability insurance?

Employer liability insurance assists in the settlement of cases involving employee injury. Employment practices liability insurance (EPLI) protects employers from litigation arising from their hiring practices.

Both actions shield business owners from employee claims, which can cost up to $125,000 in damages.

EPLI, on the other hand, is a separate insurance policy that protects your company from claims of discrimination in the workplace, wrongful termination, or creating a hostile work environment. EPLI is not included in workers' compensation, unlike employer liability insurance.

What Are the “Limits” on an Employment Practices Liability Insurance Policy?

EPLI policies are usually limited to between $1 million and $25 million in total coverage — you can choose how much coverage you need. Settlements, judgments and legal defense costs are typically included in policies' aggregate limits.

Some policies have limits on claims related to immigration. Certain policies limit their coverage during staff reductions, mergers and acquisitions. Businesses should carefully consider worst-case scenarios for their type of business and industry before selecting a policy.

Certain policies specify that when claims are filed, the insurance company will choose an attorney to defend the insured firm. These attorneys are typically chosen based on their relevant expertise to the type of claim that's filed. Note that legal fees can make up a large portion of Employment Practices Liability Insurance benefits.

If your company prefers to work with specific attorneys, you should make sure that the policy you have in mind permits you to do so; some policies may be amended to enable this.

Most EPLI policies are provided on a "claims-made" basis, meaning that claims will only be covered when both the incident in question and any claims related to it occur while a policy is active.

This means that even if an incident took place while a policy was in effect, if a claim related to it is filed after the policy in question expires, that claim is not covered under the policy. In some cases, the end date for certain policies may be extendable.