What is Directors & Officers (D&O) Insurance?

The following are just some of the claims that could be brought against your business' directors and officers at any time, costing you hundreds of thousands of dollars:

-

An investor sues a company executive for breach of fiduciary duties.

-

Customers allege a pattern of misconduct that your board of directors failed to detect.

-

An executive claims she was wrongly let go due to actions by certain other executives.

Directors and Officers Insurance - the most important line of defense in a business's Management Liability - will protect you and your business.

Directors and Officers Insurance protects your personal assets and gives you the decision-making freedom to grow your small business, regardless of the decisions taken at the top.

We shop for you! Compare rates from +10 top carriers

How much does Directors & Officers Insurance cost?

After submitting the application you get a quote estimation (i.e., you know the price). But before you can purchase it and activate the policy, someone at CoverWallet will need to manually verify the information provided and may request from you supporting documentation (e.g., financials).

After raising a series A, startups pay $9,600/yr on average. As a rule of thumb, if you have less than $50M in revenue, it will cost you ~$4K annually per $1M limit of coverage. Although prices can start at as low as $500 per $1M of coverage. And startups usually purchase limits between $1M and $3M.

Note: there are certain industries that have higher D&O risks (e.g., fintech or healthcare), so prices can be higher.

Median cost of D&O Insurance for startups

| Raised <$5M | Raised $5M-$20M | Raised >$20M |

|---|---|---|

| ~$3,800/year | $9,600/year | $17,000/year |

Note: Although we understand that every startup has different risks, we like to be data driven, and customers ask us to show a median value to provide guidance

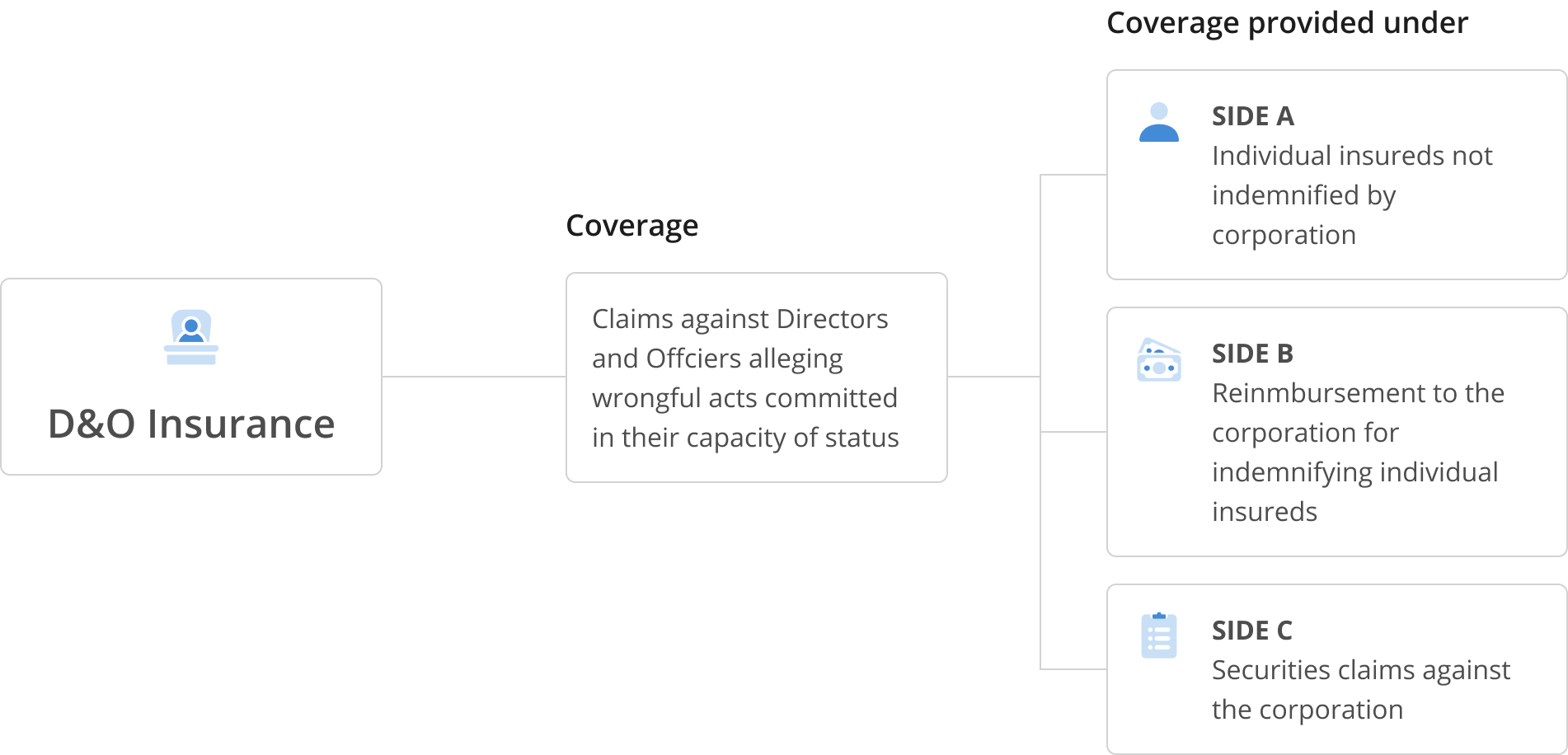

What does Directors & Officers Insurance cover?

It protects board members and officers who are sued by customers, partners, competitors or regulators over decisions they make for the company. It covers legal defense (i.e. attorneys) costs and potential settlements, that otherwise would need to be paid from the personal pockets. It covers them even if they leave the startup.

Most companies buy it after raising a new round of financing, to comply with a requirement of the term sheet and the investors since they will likely put someone on the board and they want that person to be covered from legal liability.

What Directors and Officers Insurance Is All About:

What Does Directors and Officers Insurance Cover?

Frequently Asked Questions

Does D&O Insurance cover former directors?

Directors and Officers insurance is often written to cover not only current members but also past and future.

Is D&O Insurance compulsory?

While Directors and Officers insurance is not compulsory, it is a critical part of your insurance portfolio. Because the directors and officers of your organization are putting their personal assets on the line by helping to make important decisions, it would be a smart move on your part to return the favor and help to protect them.

Who Is Covered by Directors & Officers Insurance?

Your Business If a lawsuit is brought against your business or organization claiming that the directors or officers have mismanaged funds or the strategic operations of the company, then the corporation will be covered for losses and defense costs less the retention.

Management Team The directors and officers of your organization will be protected under this policy including their personal assets. Sometimes employees further down the company hierarchy are also insured but this varies by insurance policy and the source of a claim.