What is Commercial Property Insurance?

Thankfully, this insurance policy is one of the simplest and most common forms of business-centered policies available. Commercial Property Insurance is designed to cover most physical properties your business owns. The focus of this insurance is to help businesses recover quickly after suffering property damage or loss.

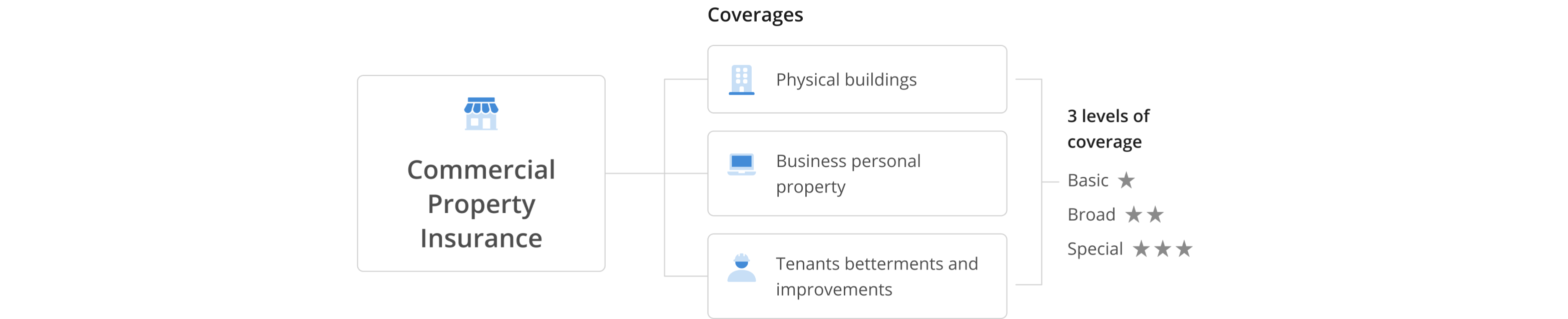

All types of business property are covered by this type of insurance policy. Many businesses choose to purchase this policy as insurance on a physical building. However, other types of business property can be covered by this policy, including physical copies of company records which are often stored onsite. All costs related to the business property can be covered. The cost of rebuilding after a building has been destroyed, or the cost of replacing property that has been completely lost are common coverage areas.

Any revenue that is lost, and that is insured by this type of insurance, can often be recouped. This insurance is designed specifically to help a business continue operating after property loss or damage.

Best in class insurance partners

What Does Commercial Property Insurance Cover?

Frequently Asked Questions

What are the factors that affect the cost of Commercial Property Insurance?

There are many factors that will affect the cost of your Commercial Property insurance. First and foremost, the coverage limits that you have on the property will affect the premium.

Certainly, the higher the limit the higher the premium. Additionally, any claims history and the higher the risk your business presents will affect the cost. For example, if you are selling fireworks indoors, that would present more risk than a clerical office setting.

What is an all risk Property Insurance policy?

While it sounds like the words all-risk would mean that everything is covered, it is important for you to know that is not the case. All-risk means that all perils are covered unless they are excluded.

It is critical for you to pay attention to the exclusions within your Commercial Property policy.

There are some common exclusions to look out for which include flood, pollution, damages by rodents or pests, wear and tear, and earth movement.

What are the two types of Property Insurance?

As discussed above a common Property insurance type is all-risk which will cover most physical damage claims to your property.

The other type of Property insurance is named-peril coverage which is less comprehensive and will only provide coverage for specifically named perils like wind, fire, and business interruption.

What is a Property Insurance premium?

The word premium can be confusing as it is defined as many different things in the dictionary. For insurance purposes, though, it means the cost of the policy. The annual policy premium is the amount you will pay for the Property insurance for the year.

What Are the “Limits” on a Commercial Property Insurance Policy?

Commercial Property Insurance is specifically limited to property owned by the business. This property must have either been purchased by the business or have been purchased from someone else and had its ownership transferred to the business. This property should be essential to the operations of the business, even if it is not directly tied to the revenue stream. This type of insurance does not cover commercial vehicles. Although commercial vehicles could be considered “property” of the business, separate insurance exists for commercial vehicles due to separate regulations.

What is Commercial Property Insurance physical asset?

Commercial Property Insurance covers everything you own that fits under the definition of a “physical asset." This can be anything, as long as your company can prove that the item was purchased for business purposes, or that its use is solely business-related. Even if your company only stores physical documents, these too could be at risk. Office equipment, buildings, and mechanical equipment are only examples of what can be covered. Speaking with an insurance agent can help business owners determine the full list of items their business owns that will be covered.

Not all businesses utilize physical assets as part of their daily operations. For example, a small business that operates online may not have many physical assets beyond computers. However, those computers would be considered business property. As such, their loss could be costly at best and potentially catastrophic.

Whether property is lost or damaged as the result of a natural disaster, criminal mischief or any other event beyond your control, any loss will result in a financial burden. This type of insurance will cover the cost of replacements, repairs, lost income, building costs, and can even cover higher costs that due to inflation.

How Much Does Commercial Property Insurance Cost?

Cost of this type of insurance will depend on several factors. The value of the building and the assets inside of it will determine the cost. A set rate is often determined by calculating the total value of these assets, and will typically include a risk factor. Different business properties have different risk factors, dependent upon their location and the nature of the business.