What is Inland Marine Insurance?

Inland Marine Insurance covers cargo that transported on water, land and/ or air. This could be transport via trains, planes, barges, trucks and more.

Not to be confused with Ocean Marine Insurance, that covers goods only transported on water.

Inland Marine Insurance, on the other hand, covers both ocean and land and air transportation.

If you use any of these three methods of transporting your goods, then you'll need Inland Marine Insurance.

A commercial Inland Marine policy doesn't just protect the goods that are currently in transit. It protects the goods even while they are not moving during the shipping process - for example if an incident occurs while the goods are temporarily warehoused.

Inland Marine Insurance can also provide protection during the delivery process and beyond.

We shop for you! Compare rates from +10 top carriers

What Inland Marine Insurance Is All About:

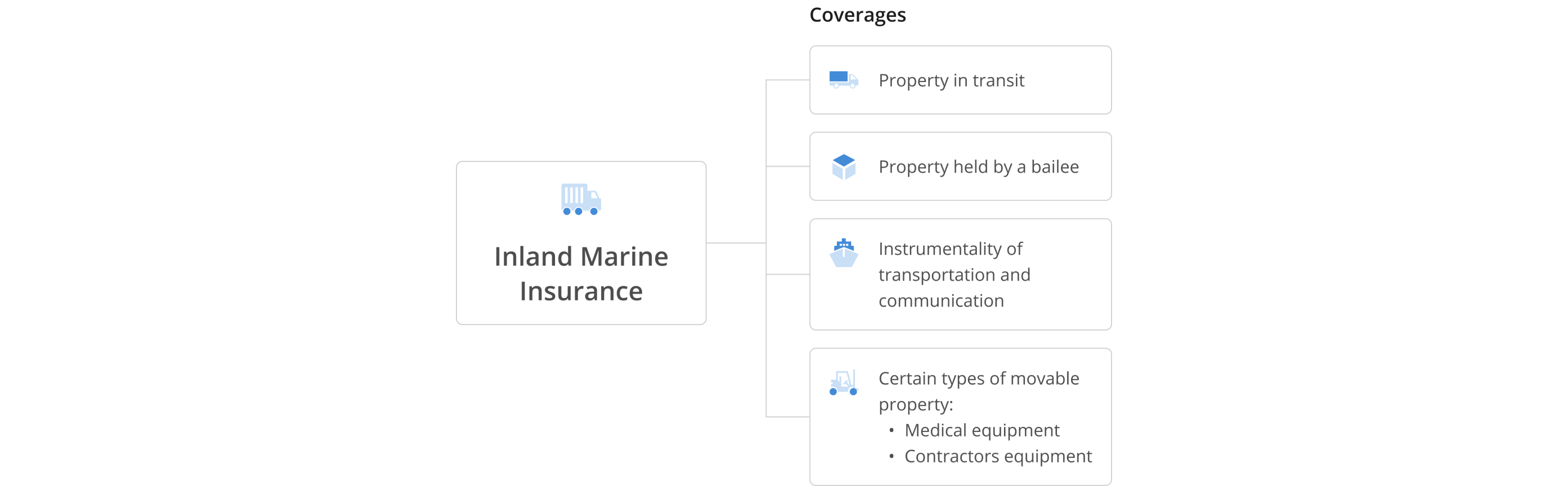

What Does Inland Marine Insurance Cover?

Frequently Asked Questions

Do I Need Inland Marine Insurance?

Inland Marine Insurance will come in handy if:

- You ship cargo on land.

- You ship high value items or high volumes of lower value items.

- You have other types of property that is constantly moved from one place to another.

- The property has a chance of being damaged or lost during transport.

- You want to protect your business from a potential loss.

- You want to protect your business from potential liability.

What Are the “Limits” on an Inland Marine Insurance Policy?

The limits on this insurance will vary based on the coverage you have and the limits you have.

Keep in mind that Commercial Inland Marine Insurance is a customizable type of insurance based on the type of business you are in and how much coverage you need.

There are no current state requirements for this insurance which means you can get as much or as little protection as you want for your business.

Since this insurance type is not a required insurance, nothing is forcing you to get it. However, it is a broad kind of insurance which means it can provide a lot more coverage for your business.

It covers things that Ocean Marine Insurance does not cover and can help fill in the gaps with protection that can save your company a lot in potential losses.

What does cargo mean for the purposes of Inland Marine Insurance?

Cargo, for insurance purposes, means the product or goods that you are transporting from one place to another. This could be anything from food to liquid to paper products.

How Much Does Inland Marine Insurance Cost?

The cost of a Commercial Inland Marine policy will depend on your business size, the amount of protection you want and any state required limits you’ll need to meet.

The best way to to get a true idea of cost is to get a quote specifically for your business and to review it carefully to make sure all of your concerns are truly covered. Filling out Commercial Inland Marine Coverage forms will help start the process.

Is an Inland Marine policy a separate policy from my General Liability?

An Inland Marine insurance policy will be separate from General Liability insurance. While it may be added to a package policy, it is often a separate policy.

Is equipment floater the same as Inland Marine?

An Equipment Floater is a type of Inland Marine insurance policy. An easy way to understand what Inland Marine insurance covers is to think of it as a policy for things that are mobile. This includes equipment, whether for a construction company or a farm.

Who is covered by Inland Marine Insurance?

Your Business If your business needs specific equipment to operate then you will have protection for it under Inland Marine insurance. This can be anything from construction equipment, to medical supplies, to art and photography equipment.

Your Customers If your clients leave their property in your possession to be stored, they will be covered for physical damage or theft of the property while it is in your care.

Your Vendors Any company that rents or leases equipment to you will require that you provide insurance coverage for the product while it is in your possession. They are protected under your Inland Marine coverage as it will repair or replace lost equipment.